Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

World Market is an on-chain perpetual decentralized exchange where you can trade crypto, commodities, forex, stocks, or bonds with leverage using any on-chain asset.

Global markets have long been a key application for blockchain technology. Centralized exchanges (CEXs) gained popularity in the early 2010s by offering spot trading and easy access to global cryptocurrency markets. In 2014, BitMEX introduced Perpetual Futures, transforming the trading landscape. This innovation was quickly adopted by other CEXs and fueled market expansion over next few years. By 2020, DeFi gained momentum with perpetual futures decentralized exchanges (DEXs) offering trustless and permissionless trading. While these markets since then have evolved, they are still primarily focused on cryptocurrency assets with a limited expansion into real-world assets (RWAs), such as gold, silver, and very limited number of forex pairs.

In contrast, traditional non-blockchain markets, such as Contract For Differences (CFDs), offer access to over 18,000 assets, processing billions in daily trading volume. They also integrate blockchain-based assets faster than DeFi markets can onboard new blockchain assets. However, CFDs often have wider spreads and higher costs, leaving users at the mercy of brokers. Several emerging asset classes, such as precious metals, yield, prediction, time-based assets, and real estate, are being developed for on-chain perpetual futures. These assets, however, are often illiquid, posing a challenge in DeFi markets, just like every other emerging asset class.

With World Market, we aim to bridge this gap by offering CeFi-level liquidity and TradFi market offerings on-chain. B3X has been working on building a derivatives marketplace designed to integrate any asset class including traditional assets and emerging DeFi assets with deep liquidity, familiar features, and seamless UX. By doing so, B3X enables DeFi to compete directly with TradFi and CeFi, providing a truly decentralized, efficient, and scalable trading platform for the world.

CeFi volumes still overshadow DeFi by a staggering 100x, with platforms like Hyperliquid driving the majority of the activity. Despite years of innovation, DeFi remains far from closing this gap. The core issue lies in limited market offerings and insufficient liquidity on DeFi venues, which stifle growth and fail to attract serious traders.

We are seeing an upward growth in DEX to CEX volume since our inception of DeFi markets and yet, we have barely captured the surface.

To compete at this scale, DeFi must deliver more than incremental improvements — it needs transformative markets that can rival CeFi in depth, efficiency, and accessibility. The time for half-measures is over.

Perhaps, it may also be due to the fact, earlier it was difficult to build such CeFi markets on DeFi due to the absence of chains to deliver similar performance as needed — but that excuse is not valid anymore, as we are seeing several high-performance chains in development now delivering the required performance.

So, the best time to compete with CeFi is now.

“Building a new foundation takes a Heraclitean approach — embracing constant change and adaptation — but once completed, it will stand as the best, enduring testament to innovation.”

B3X is an onchain derivatives protocol building the World Market for World Computer. Our vision is to utilize derivatives as go-to venue for onchain trading to faciliate launching of vaults, AI-driven tokenized funds, synthetic dollars (Ethena etc) and several other use-cases.

We believe that on-chain perpetual markets are more than just trading venues—they're modular, composable primitives in the broader DeFi ecosystem. While most treat perps as isolated platforms for speculation, we see them as foundational infrastructure for a new class of financial products. There’s significant untapped potential in building on top of these markets, and the team is focused on unlocking that opportunity—reimagining perps as DeFi Legos for innovation.

B3X is a community-driven protocol.

We actively engage with your questions and welcome feedback that helps shape the future of the protocol.

There are several problems around perpetual futures onchain, a few of the key ones are:

Huge Liquidity Potential, Yet the Never-Ending Cold Start Problem

Crypto is now a $3.5T asset class, but we still face liquidity challenges and cold-start issues at perpetual futures market launches. With just 1% of the market cap ($35B), we should be able to create efficient on-chain perpetual future markets, yet we’re still struggling.

The problem is clear: Spot DEXes and lending markets have 10x the liquidity of derivatives. Why? Because we’re limiting perpetual futures to blue-chip assets and mainly USDC onchain. Even after more than 3 years of innovation, perpetual futures still lag behind other DeFi primitives.

By neglecting a wider range of assets, we’re missing huge liquidity potential and holding back the growth of on-chain derivatives. It’s time to rethink and expand these markets.

Limited Utility for Existing Assets: A Persistent Nightmare for Holders

Sadly, the majority of assets have no utility beyond governance and staking yield. A fraction of them are allowed on lending protocols. For most, the only option is to hold and pray for an upside given their limited utility.

Holders often pray for some way these tokens can become useful, for their own sake, as they endure the PTSD of price actions — especially when every coin seems to be pumping except the ones they hold (which is often the sad truth). Perhaps if they could enjoy the price action of shiny new assets with their existing portfolio, they might just be able to endure the nightmare.

In the early days, we had Etherdelta — one of the first spot market CLOBs powered by ETH. Then came Poloniex, a once-popular centralized exchange dominated by BTC pairs. Later, BitMEX revolutionized the market with perpetual swaps powered by BTC.

Imagine the euphoria: you bought BTC, then used it to buy ETH. As ETH appreciated in BTC terms and BTC soared against USD, your returns multiplied. You could even use your BTC to long or short other assets, diversifying your portfolio.

Those days are long gone. Now, you can’t even long BTC with anything beyond blue-chip tokens or a few stablecoins at best. Even BTC — the asset with the highest market cap and largest holder base — has almost no utility in derivatives today.

If you lost USD in BTC-based perpetual futures position earlier, Bitcoin’s price appreciation could have helped recover some of your losses. However, with the majority of derivatives now collateralized by stablecoins, the opportunity for any upside recovery has been eliminated.

On-chain markets urgently need a transformative boost. To unlock their true potential, they must be powered by the most secure and highest Store of Value (SoV) asset, creating a foundation for robust, efficient, and inclusive global DeFi ecosystems. Once established, other assets will naturally follow, amplifying the ecosystem’s reach and impact.

With World Market, protocols can launch their own stablecoins backed by derivative positions collateralized by their native tokens. This is similar to USDe by Ethena, but fully on-chain, decentralized, and capable of being collateralized by any on-chain asset.

Protocols can mint these stablecoins to bootstrap incentives, create DEX pools for liquidity both within and outside World Market, and avoid the sell pressure typically caused by directly allocating tokens for incentives.

Moreover, these stablecoins can be used to launch new markets in World Market, enhancing their utility beyond just being a stable asset or incentive.

Join the stablecoin revolution and leverage DeFi utilities offered by World Market for even more possibilities.

The protocol’s architecture can be summarized as follows, where the components of the protocols are modular, hence the implementation of the such components relies on the actual implementation under proxy which are updated on regular basis. The possible key modules of the protocols are:

Chain: Manages protocol’s cross-chain messages, in order to achieve multichain modularity and enabling seamless trade execution for end-users.

Market: Manages protocol’s market-places, by allowing any users to permissionlessly create, modify or remove markets and adjust market related parameters.

Order: Accepts and handles protocol’s core functions, such as swaps & futures actions

Asset: Responsible for asset creation, management and adjustment asset related parameters

Oracle: Handles pricing logics and sources which includes off-chain and on-chain sources.

Role: Handles protocol’s roles which defines whitelisted actors for proper and secure functioning of the protocol.

Storage: Responsible for storing, updating and removing protocols storage state variables.

Keeper: Manages off-chain and on-chain keepers logics, their implementations and whitelisted keepers.

Router: Handles cross-contract communication for the protocol.

OrderBook: Responsible for storage and maintainence of orderbooks.

Solver: Handles intent-based solver system which lives fully onchain.

Using derivatives as a first principle to address liquidity fragmentation and the usage crisis, we aim to balance markets by empowering end-users with modular tools — delta-neutral vaults, long/short one-vault strategies, stablecoin minting, and seamless utilization across applications, including the World Market.

We believe derivatives, particularly perpetual futures, have the potential to become world-class DeFi building blocks, paving the way for a new paradigm in DeFi markets.

At World Market, LPs gain full control over the risk and economics of their markets, transforming them into first-class citizens of DeFi. This autonomy allows LPs to make decisions that align with their interests and contribute to the growth and evolution of their markets.

Protocols seeking to list themselves in existing markets will need to incentivize LPs to allocate capital to their market — usually a portion of open-interest capacity — through bribes or rewards.

LPs have the power to run their own governance, create customized incentives, and manage risks within their markets, maximizing their ownership and influence. This puts them in a unique position to shape the DeFi landscape, capturing more mindshare and market share compared to other protocols.

World Market as the trading engine of an entirely new market layer for the internet of value powered by on-chain assets.

B3X proposes a solution, the World Market — a global, permissionless blockchain marketplace that enables markets powered by any on-chain asset powered by perpetual futures.

For decades, markets have been a tale of exclusion, inefficiency, and centralized control. B3X envisions a new era — the World Market — a unified, decentralized solution to the failures of the past, inefficiencies of the present, and challenges of the future.

The World Market will simplify the market experience. Anyone can buy BTC using any memecoin, stablecoin, LP token, and more, all powered by derivatives. Too much risk? Take 1x leverage without the hassle of switching chains or selling your portfolio.

Why utilize derivatives for the World Market? Because we want everyone to access global markets without restrictions on what assets they can use. You should be able to trade, no matter how the markets move, using your favorite on-chain asset.

Using derivatives to power the World Market enables it to offer a vast range of market offerings, surpassing those of CeFi and current DeFi protocols, thereby creating a unique value proposition to onboard non-crypto natives and TradFi.

Through the World Market, B3X aims to enable deep liquidity to flow into derivatives, building efficient and effective capital markets. We are still in the early stages of derivatives, and the market potential is immense. For collateralization and deep liquidity, we have $3.5T worth of assets, while global derivatives represent a market worth over one quadrillion dollars.

We aim to onboard over 5% of the market capitalization to supercharge DeFi with the World Market. We know it’s a bold leap, but we’re not alone on this journey.

World Market transforms your portfolio into a capital-efficient powerhouse, empowering you to actively engage in DeFi rather than passively sitting on the sidelines, hoping for the upside. With World Market, you don’t just wait for the future — you trade it.

Collaborate, Don’t Compete: Building a Unified Global Liquidity Layer

DeFi must shift its mindset from competition to collaboration if we are to create a truly global liquidity layer that transcends blockchain ecosystems. The constant infighting over TVL and yield incentives only weakens the space, while CEXs have been pooling and sharing order book liquidity from day one, giving them a massive edge.

Vampire attacks and siloed liquidity fragment DeFi, making it harder to compete with CeFi’s scale and efficiency. By working together, DeFi protocols can unlock shared liquidity and scalability, paving the way for a seamless trading experience and sustainable growth for the entire ecosystem.

Reestablishing LPs as First-Class Citizens of DeFi.

It’s about rethinking the role of LPs, ensuring they aren’t just passive liquidity providers but active, well-rewarded participants driving the DeFi ecosystem forward.

LPs in the World Market have full governance over the market offerings provided by the pool. This ensures that LPs — who bear the majority of the risk — have a say in how their capital is allocated and utilized.

Imagine your positions as LPs on lending markets, other derivatives protocols, staking protocols, yield generating vaults — now available to be utilized as collateral to access World Market offerings — so you can long and short your next 100x gem without hassle.

World Market — can be powered by staked and restaking TVL enabling LPs to still become first-class citizen and furthermore do more with their LP positions — long or short — 100x memes, ai agents and yield across other protocols.

World Market will transform LPs into active traders, further fueling the growth of LPs and enhancing their influence within DeFi.

Not a trader, but looking for additional yield? Provide liquidity as LP at world market to get additional boosted yields on your existing LP position.

World Market allows liquid staking assets that accrue yield to be utilized in the creation of yield-bearing stablecoins, similar to delta-neutral stablecoins. Thanks to the modular and composable design of World Market, we can introduce enhanced capital efficiency and utility to these assets.

These stablecoins will earn yield through the underlying asset and funding rates.

Like any other asset, these yield-bearing stablecoins can be leveraged to launch new markets on World Market, maximizing their utility and enabling even more opportunities for growth.

As one of the core risk management mechanics, ADL acts as a buffer to backstop profit distribution in an event of volatile price actions to prevent systematic risk to the market. If an asset is highly volatile, the protocol deploys additional measures such as ADL, to de-leverage the position automatically as the time passes if it occurs profits. In this mechanism, the pool which acts as counter-party to all the position in Open Interest forcefully takes over the position and liquidates it with profit to prevent future profit drainage. The priority queue depends on the nature of markets and the direction of trade. The ADL Keepers will consistently check the health of the active positions and deleverage by taking over the position and initiating force closure, which may result in partial liquidation.

Let us define , as position size and collateral amount in USD and , as leverage of the position, then

Since is a constant, hence the relation can be established as

The Funding Rate Module makes funding rate arbitrage easy, so you don’t have to track it manually or manage complex positions.

Imagine continuously harvesting the funding rate — simply deposit into these vaults and let the yield come to you. Vault managers will actively allocate capital to delta-neutral positions with a negative funding rate. Once the rates turn positive, the positions are closed, and profits are realized.

With the development of the intent solver-based design, vault managers can seamlessly migrate positions from pool or CLOB to intent, often with opposite funding rate directions.

Thanks to the use of inverse perpetual futures, most markets on World Market allow positions to be delta-neutral, accruing negative funding rates without holding spot.

The goal is to make basis-point trading accessible to everyone and balance the open interest of World Market.

Each vault module will issue an LP token to represent your ownership, which can also be used to launch new markets on World Market.

Rehypothecation: Empowering Liquidity, Preserving Ecosystems, Bridging Chains.

Rehypothecation allows us to use liquidity without emptying our partners and DeFi in general, instead onboard new liquidity on top of it.

If you’re a protocol with significant TVL that’s prone to idling and becoming stagnant, World Market can supercharge your protocol and enable your users to do more — without resorting to vampire attacks.

Such protocols can list trending DeFi assets, collateralized by their protocol tokens/assets and powered by World Market. This approach will not only boost their TVL but also generate additional yield while keeping users engaged.

World Market allows our competitors to tap into our deep liquidity, enabling them to scale themselves or build better markets using our robust infrastructure.

World Market will enable all protocols to access the markets beyond their own deployments.

Modules: Our Modular Expansion for World Market Infrastructure

B3X is building not just the World Market but also pioneering use cases to unlock its full potential.

Introducing Modules — the infrastructure component that gives you the freedom to build anything with World Market. Whether it’s a synthetic dollar like Ethena’s, a Long-only Vault, a Short-only Vault, a Funding Rate Vault, or any other innovative solution, our modular design empowers you to create custom financial products that suit your needs.

The significance of Modules in World Market is straightforward: derivatives cater to the diverse use cases of general market participants. Some of them are as follows:

This layer contains applications that require human oversight and decision-making. These components provide the interface through which users interact with the World Fund ecosystem.

The Fund Marketplace connects investors with fund managers, enabling capital allocation and performance tracking:

Fund Discovery: Investors can browse and filter funds based on strategy type, performance metrics, risk profiles, and other key parameters

With the World Market, you can create long-only vaults where the collateral staked in the vault is used to open long positions across specific markets as determined by the vault manager.

For example, you can create your own cryptocurrency index, like YOUR5, which tracks Asset A, B, C and D, with a equal weight distribution.

This module allows you to launch a vault that automatically takes long positions with 1x leverage and allocates capital according to the specified weights. Essentially, you’re trading your custom index in real-time.

Each vault module will issue an LP token to represent your ownership, which can also be used to launch new markets on World Market.

LPs: Unfairly Treated as Passive, Second-Class Citizens

Liquidity providers (LPs) have long been treated as passive, second-class citizens in the DeFi ecosystem. Harmony is missing, and LPs often face chaos when supplying liquidity or taking actions, as market dynamics change constantly. LPs are left exposed to unpredictable risks without the tools to manage or capitalize on them effectively.

LPs should have the same rights as traders — able to actively manage and trade their positions. Since LPs essentially take the opposite side of trades, they must be empowered to hedge or even boldly trade using their LP positions.

Given the significant risks LPs face, they should be granted the power to govern where and how their capital is deployed. After all, LPs have been the financial backbone of DeFi, supporting innovation from its earliest stages. It’s time they are treated as the critical players they truly are.

The Lending Module extends World Market by enabling two key functions:

Traders can borrow against their positions.

LPs can borrow against their positions.

In return, lenders can capitalize on the positions and accrue yield — whether from funding rates on positions or fees on LP assets.

The goal of this module is to make World Market trades and LP positions more liquid, allowing for greater flexibility and yield generation across the ecosystem.

World Market will enable users to speculate, hedge, or construct new financial primitives around previously untapped informational and economic domains.

On-chain perpetuals are set to change the game in DeFi, offering new ways to tap into liquidity, leverage, and financial innovation. With World Market, we’re taking it even further.

Redefining Market Efficiency: No Perfect Settlement, Only Better Solutions

Central Limit Order Books (CLOBs) aren’t the answer to efficient markets — they merely amplify stablecoin usage while sidelining other assets. Their structure prioritizes a narrow asset range, leaving the vast potential of DeFi in the dust.

On the other hand, liquidity pools aren’t perfect either. They require excessive inventory for trade execution, far more than other settlement systems, leading to inefficiencies and straining liquidity providers. While they can accommodate a wider range of collateral options, they fundamentally fall short in offering diverse market options.

Lastly, Intents only can handle markets which already exists for Solvers (Market Makers) to hedge, fundamentally restricting them to list anything not supported by CeFi, at current stage.

DeFi needs more than outdated paradigms — it requires innovative market structures that balance efficiency, inclusivity, and scalability to unlock its true potential. The current systems aren’t just imperfect — they’re limiting progress.

Perhaps we could focus on refining these designs and exploring ways to integrate them seamlessly for a more unified outcome.

Capital Allocation: Simple interface for investing in and withdrawing from funds

Performance Analytics: Comprehensive dashboards for tracking fund performance against benchmarks

Manager Profiles: Transparent information about fund managers, their track records, and strategy descriptions

The Fund Builder enables strategy creation through natural language, making sophisticated quantitative trading accessible to non-technical users:

Conversational Interface: Users describe trading strategies in plain language

LLM-Powered Translation: AI models translate natural language into executable trading code

Interactive Refinement: Users can iteratively improve strategies through feedback loops

Strategy Visualization: Clear visualization of strategy logic and expected behavior

Parameter Configuration: User-friendly interfaces for setting and testing strategy parameters

Human-operated funds are managed directly by human fund managers who make strategic decisions while leveraging the platform's infrastructure:

Strategy Management: Tools for developing, backtesting, and deploying strategies

Portfolio Construction: Interfaces for building diversified portfolios across multiple assets

Risk Controls: Systems for setting and monitoring risk parameters

Execution Management: Tools for optimizing trade execution and monitoring market impact

Performance Reporting: Comprehensive analytics on fund performance and attribution

While human-driven, these applications seamlessly integrate with the AI-driven layer below:

Strategies created in the Fund Builder can be validated and optimized by the Quant Agent

Human-operated funds can leverage AI recommendations while maintaining human oversight

The Fund Marketplace incorporates AI-powered analytics to help investors make informed decisions

This hybrid approach combines human creativity and judgment with AI-powered analytics and execution, creating a powerful synergy that amplifies the capabilities of both.

With World Market, we are opening the door to a new era of on-chain markets, including but definitely not limited to:

LP Yields

Stablecoins

Bonds

Hashrate

Blobs

LPs can fuel the growth of these markets with their own liquidity or incentivize existing LPs to expand their offerings.

Traders simply choose their collateral and market offering to take positions seamlessly. The future of DeFi markets starts here.

The fundamental issue plaguing DeFi is the underutilization of existing TVL, resulting in low yields despite billions locked in protocols.

World Market transforms this narrative, enabling full-scale utilization of TVL in ways previously unimaginable.

With LPs elevated to first-class citizens, they can actively trade global markets using their LP positions, fostering excitement about DeFi’s future and their role in it. Beyond trading, new incentive programs amplify their engagement, paving the way for a more dynamic and sustainable ecosystem.

This is how we redefine TVL growth — by unlocking untapped value.

World Market enables users to seamlessly achieve their intentions. For example, if a user wants to buy Asset A using Token B, but needs to supply Token C to acquire A, World Market automatically converts B to C and then purchases A — without the user even realizing it. Whether C is a token, LP, or any other asset, World Market takes care of the complexity, providing a frictionless experience for the user.

Increasing token utility reduces liquid supply, making tokens harder to acquire and governance attacks more difficult. For instance, in the COMP case, the reduced availability of tokens raises the threshold for creating proposals and achieving quorum, thereby enhancing governance security.

Furthermore, protocols can empower stakeholders — such as stakers or holders utilizing tokens in other markets that boost value — to participate in governance. This reduces the influence of liquid token buyers who swoop in at the last moment to manipulate votes.

DeFi has long struggled with liquidity issues, constantly hunting for deep liquidity and facing the same two questions: why you? and what do you offer? With World Market, liquidity finds its natural home, becoming capital efficient and no longer idly searching for utilization.

World Market’s ability to launch new incentives and offer superior DeFi utility is what sets it apart.

World Market can act as the global execution marketplace where users can submit their intents, which will produce actions to achieve the intent and execute to get the result.

From the previous example, imagine an AI agent processing the user’s intents (buy jitoSOL, sUSDe, and OM), which can be achieved through a series of actions (long jitoSOL, sUSDe, and OM), all executable on the World Market.

Get exposure to yield without holding the underlying LP asset. LPs at World Market can list their yield, allowing traders and other market participants to easily trade it. We will be collaborating with yield trading protocols so you can leverage your LP tokens to hedge, short, or go long on your yield.

With World Market, you can trade yields from Ethena, 10Y US Treasury, Aave’s WBTC yield, and much more.

What’s even crazier? You can trade yield with yield to maximize your returns for even greater yield.

Existing LP based perpetual futures DEXes have several limitations in enabling new markets to their existing offering. With World Market, they can easily scale up with their offering by launching Protocol-Owned Markets.

Existing Orderbook based protocols can use World Market to launch Protocol Owned Market catering towards their own community or users.

Intent based protocol often require additional solver or external solver. With World Market, they can launch markets available World Market Pool, Orderbook or Intent Solver where the settlement and liquidity is readily available for bootstrapping.

A existing LRT, LSD, DEX or any protocol with their own community can explore using World Market Interp Layer to enable perps as product offering without any additional efforts for additional source of revenue or market exposure.

Efficient Liquidity, Unlimited Scale: The Future of Open Interest.

The World Market adopts a pool-based design as the primary settlement venue in its first iteration, leveraging its flexibility for diverse market offerings and collateralization.

However, it is different than the existing pool-based models.

In each World Market pool, liquidity moves with the market offering demands in real time. Because market offerings will usually higher than majority of the protocols, liquidity is dynamically allocated yet readily available.

For example, if a World Market pool has 500 market offerings and a total liquidity of 100M, it does not necessarily mean that the 100M is evenly split across the 500 markets. Instead, the entire 100M is initially available to each of the 500 market offerings. This creates a dynamic competition to utilize the liquidity, effectively eliminating idle liquidity and ensuring it is directed toward use cases that can employ it most efficiently.

To enable true price discovery and a familiar UX, we will be working on building a fully on-chain orderbook to scale the World Market’s liquidity. Later, we will introduce intent-based settlement to allow LPs and traders to hedge effectively and accelerate the World Market.

Orders will be routed to best trade execution venue price-cost priority.

Furthermore, the pool-based venue acting as the counterparty for the first iteration of World Market will leverage an orderbook to hedge itself. Additionally, market makers (MMs) or traders in the orderbook can use the intent-based model to hedge further, and vice versa. This ensures that liquidity is efficiently utilized across all models, enabling us to scale to a virtually unlimited open interest model. These venues — pool, orderbook, and intent — can tap into an Insurance Fund to borrow capital for hedging and covering costs.

This will enable the Pool-model design can support deeper liquidity than existing protocols, and make the World Market more capital efficient.

Our main goal is to make World Market accessible to all end users irrespective of the chain they are on.

The Average Crypto User: A Tale of 100x Gains and a Maze to Navigate

Imagine you’ve already invested in ai16z and made your 100x return. Now, you want to diversify into jitoSOL on Solana, sUSDe on Ethereum, and OM on Mantra for stable yields and exposure to Solana’s price action and RWA chains.

The current process would involve selling ai16z, using part of it to buy jitoSOL, then bridging some to Ethereum to swap for sUSDe or stake it. You’d then swap to sUSDe, and finally, bridge the rest to Mantra to buy OM or stay on Ethereum to purchase OM there.

This is a terrible user experience. Most users will struggle with this complexity. We’re not there yet, even with AI agents. Users must navigate through three fundamentally different blockchains (Solana, EVM, Cosmos), which is overwhelming.

The World Market is here to eliminate this UX nightmare and onboard average users without the need for endless blockchain education.

With the World Market, you can directly use ai16z tokens to buy jitoSOL, sUSDe, and OM — no need for selling, bridging, or chain-hopping. Enjoy the same upside and yield while maintaining the full potential of your ai16z tokens.

Through the World Market, users can now:

Trade any asset or data stream, literally.

Trade using the majority of on-chain assets, for real.

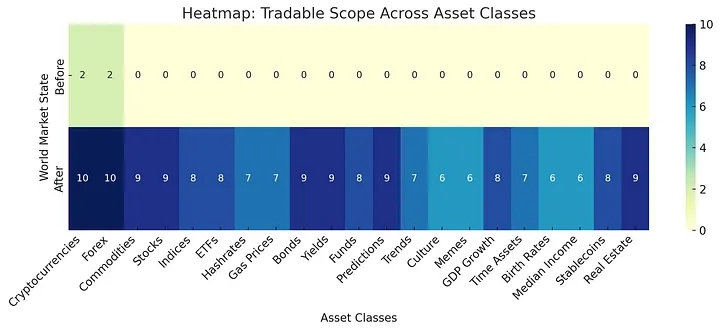

Cryptocurrency, forex, commodities, stocks, indices, etfs, hashrates, gas prices, bonds, yields, funds, predictions, trends, culture, memes, gdp growth, time assets, birth rates, median income, stablecoins, real estate, and so much more.

World Market presents infinite possibilties.

What can you trade with?

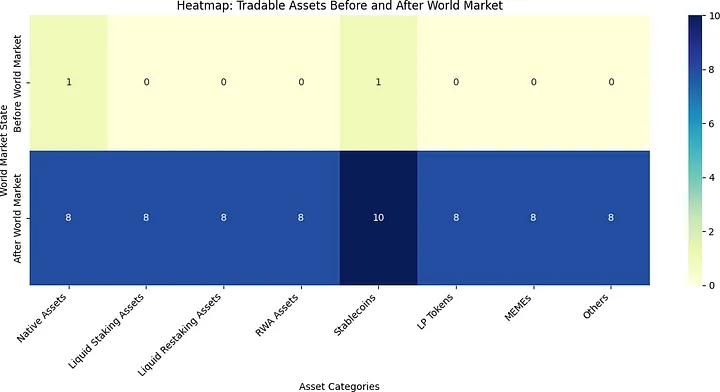

Almost any onchain asset including:

native assets (BTC, ETH, SUPRA, etc),

liquid staking assets (wstETH, rETH, LBTC, etc),

liquid restaking assets (eETH etc),

RWA assets (BENJI, BUIDL, etc),

Your portfolio holds more value than you think — capitalize its true potential with the World Market.

World Market is engineered to seamlessly integrate with every protocol, blockchain, and end-user, creating a universal distribution layer.

World Market transforms how liquidity operates across blockchains by providing a unified market of markets. As more markets and chains integrate with World Market, each deployment benefits from broader access to liquidity, without the need to extract TVL or yield from one another.

Instead of draining value, World Market strengthens TVL across chains, enhancing the ability for users to unlock new opportunities with their holdings, while preserving and growing their assets.

World Market isn’t just about blockchains — it connects directly with protocols and their users, offering a wide array of use cases to the blockchain ecosystem they can:

Generate additional yield with existing TVL

Onboard capital-efficient TVL without draining it

Access deep liquidity without vampire attacking other chains

Enable DeFi-native utilities for ecosystem projects and assets

With World Market, protocols can take control and launch their own markets, empowering their users with unparalleled opportunities:

Launch your own stablecoin using our customizable modules

Create your own market on World Market, enabling users to long or short your token

Collateralize a market with your token, allowing holders to long and short the world using your asset

Offer long-only vaults for your token holders

At World Market, users are more than just traders — they’re power users, capable of:

Trading with portfolio assets without the need to sell

Generating additional yield with existing holdings

Creating custom indices and personalized trading strategies

Building and managing trading vaults

And much more, all at your fingertips.

Pricing is one of the most critical components of any derivative protocol. To achieve our vision, we have implemented additional measures to ensure fair, transparent and tamper-proof pricing for all the end-users irrespective of role: Liquidity Provider or Traders.

The protocol adapts intent-based design to compute, validate and submit prices on-chain for intent execution. Upon user's request submission to the smart contract, a series of on-chain and off-chain events occur to submit the pricing required for executing the request.

The final price ‘ ’ of an asset at time ‘t’ on the protocol can be represented as

where can be defined as the price of the asset from decentralized sources, represents the respective pricing and weight of the decentralized sources while is a black box function to ensure tamper-proof pseudo-deterministic price for fair trade execution,

and can be defined as the price of the asset from real-world sources and represents the respective pricing and weight of the real-world sources in form of a time-series function as

For simulation, we will plug in and define then

where

The liquidation price for an asset for all active positions will differ, but considering rest of the parameters constant, it can be defined as

The liquidation price of the position is not computed as general pricing formula to ensure fair and transparent liquidation, especially in the event of volatile market conditions.

Hence, at any given time ,

Based on the volatility of the market and asset, the protocol deploys additional parameters to safeguard LPs and prevent systematic risk to the protocol. One such factor is Spread Factor. If Spread Factor, is defined for an asset in a market by market creator, the final price to open/execute a trade in any direction will be

Depending on direction,

And the final price to close such positions can be defined as

Depending on direction,

World Fund features a layered, modular architecture designed for flexibility, scalability, and seamless integration with existing DeFi infrastructure. The system is structured into four distinct layers that work in concert to deliver a comprehensive fund management ecosystem.

The World Fund architecture consists of four primary layers:

- The interface for traders, investors, and fund managers

- Applications requiring human oversight and decision-making

- Autonomous components that operate with minimal human intervention

- Foundation services and tools supporting the entire ecosystem

Each layer is designed with clear responsibilities and interfaces, creating a modular system that can evolve over time.

A key architectural advantage of World Fund is its purpose-built integration with World Market, our specialized Perpetual DEX. This synergistic design provides unique benefits:

Optimized performance through deep integration between strategy execution and market infrastructure

Enhanced feature compatibility with specialized World Market capabilities designed specifically for World Fund strategies

Superior security through end-to-end control of the trading lifecycle

Streamlined user experience with unified account management and permissions

World Fund utilizes an innovative Agent Wallet mechanism to ensure secure and automated strategy execution on World Market. This security-focused approach works through limited-permission secondary wallets that:

Execute trades and manage positions without withdrawal permissions

Apply strategy-specific risk parameters defined by the fund creator

Operate within strictly defined boundaries and fail-safes

This approach ensures both autonomy and security in strategy execution while maintaining complete separation between fund custody and operational execution.

Each architectural layer is described in more detail in the following sections.

World Fund is built on a fully decentralized architecture that ensures transparency, security, and resilience. This architecture enables trustless operation while maintaining high performance and adaptability.

The World Fund ecosystem is governed through decentralized mechanisms:

Protocol Governance: Key protocol parameters and upgrades are determined through on-chain voting

Strategy Governance: Validation and deployment of strategies to the curated library follows a decentralized approval process

Risk Parameter Governance: Risk controls and limits are subject to decentralized oversight

Fee Structure Governance: Economic parameters are adjusted through community governance

Strategies are executed through a transparent on-chain process:

Immutable Strategy Storage: Validated strategies are stored on-chain with tamper-proof guarantees

Transparent Execution: All strategy execution steps are visible and verifiable on-chain

Verifiable Performance: Strategy performance metrics are calculated from on-chain data

Automated Settlements: Position adjustments and fund allocations occur through smart contracts

To optimize for both performance and trust, World Fund employs a hybrid approach:

Off-chain Computation: Intensive calculations for strategy generation and optimization occur off-chain

Off-chain Data Processing: Market data analysis and signal generation happen off-chain for efficiency

On-chain Verification: Key results and decisions are verified and recorded on-chain

Cryptographic Proofs: Where appropriate, zero-knowledge proofs verify off-chain computations

The decentralized architecture incorporates multiple security layers:

Multi-signature Controls: Critical actions require approval from multiple authorized parties

Time-locks: Important system changes include time-delay mechanisms for safety

Circuit Breakers: Automatic safeguards halt operations under extreme conditions

Formal Verification: Core smart contracts undergo formal mathematical verification

A key innovation in World Fund's decentralized architecture is the Agent Wallet system:

Limited-Permission Execution: Agent Wallets can only perform specific trading actions, with no withdrawal capabilities

Strategy-Specific Parameters: Each wallet operates within clearly defined boundaries set by the strategy creator

Cryptographic Authentication: Secure authentication ensures only authorized systems can initiate actions

Transparent Operations: All Agent Wallet actions are publicly visible and auditable

The architecture supports operation across multiple blockchain ecosystems:

Chain-Specific Adapters: Integration with multiple blockchain environments

Uniform Strategy Interface: Consistent strategy representation regardless of underlying chain

Cross-chain Synchronization: Coordination of strategy execution across different chains

Liquidity Bridges: Seamless movement of capital between different blockchain environments

This comprehensive decentralized architecture ensures that World Fund combines the benefits of trustless operation with the performance and sophistication required for advanced fund management.

The Long vs Short Vault Module lets users take both long and short positions simultaneously, depending on their strategy. Collateral deposited into the vault is used to create positions on World Market that align with the vault’s intended strategy.

For example, if you’re a SOL maxi and ETH skeptic, you can long SOL while shorting ETH at the same time, effectively creating a SOL/ETH pair. If SOL’s price rises or ETH’s price falls, you’ll profit.

This module empowers users to create dominance pairs, exotic pairs, and many more customized positions, enhancing flexibility and trading opportunities.

World Fund's functionality is delivered through three core components that work together to enable sophisticated fund creation, validation, and execution. Each component is designed to solve specific challenges in the fund management process.

The Fund Builder component enables the creation of trading strategies through natural language, making sophisticated quantitative trading accessible to non-technical users. Through an intuitive conversational interface, users can describe their trading ideas in plain language and have them transformed into executable code.

The Quant Agent is the central intelligence engine that generates, tests, and optimizes trading strategies. Using rigorous scientific methodologies, it systematically prevents overfitting while ensuring strategies are robust across different market conditions. The Quant Agent leverages the Model Context Protocol (MCP) to access specialized tools and capabilities.

The Strategy Framework provides the structure for creating, validating, and executing trading strategies. It includes the Strategy Factory and Strategy Selector (SFSS) system that ensures strategies meet rigorous standards before deployment, and supports a decoupled execution architecture that separates signal generation from order execution.

Together, these components create a comprehensive ecosystem for fund management that combines the accessibility of natural language interfaces, the rigor of scientific validation, and the efficiency of automated execution.

CLOBs for building World Market Pricing Engine

Introducing the DMM Module — Designated Market Maker Vault Module. Collateralized by any on-chain asset, not just stablecoins, it enables the trading of Asset-Margined Perps. LPs supply assets, while DMMs implement market-making strategies to create order books and take performance fees. LPs have the power to vote on which markets to list, ensuring true governance while DMMs offer feedback and perform risk management.

For example: With World Market, we can create our own CLOB markets for futures, powered by BTC — reminiscent of BitMEX’s pioneering approach. Additionally, launching BTC-powered spot CLOB markets powered by World Market can accelerate the growth of BTCFi.

World Fund represents a paradigm shift in how investment funds are created, managed, and accessed within the DeFi ecosystem. By leveraging cutting-edge artificial intelligence and a modular architecture, we have addressed the fundamental challenges that have limited the potential of decentralized fund management.

Through our integrated platform, we have democratized access to sophisticated quantitative trading strategies that were previously available only to elite institutions:

Natural Language Strategy Creation: Making fund creation accessible to anyone, regardless of technical background

Intelligent Quant Agent: Combining rigorous scientific methods with an open architecture enabled by the Model Context Protocol (MCP)

Decoupled Execution Architecture: Separating Signal Generators (for signal production) from Trader Agents (for execution optimization)

Integration with World Market: Purpose-built synergy with our specialized Perpetual DEX for maximum performance and security

World Fund directly addresses the key challenges faced by decentralized fund management:

Reducing Technical Complexity: Enabling fund creation through natural language, removing technical barriers

Preventing Strategy Overfitting: Implementing rigorous validation methodologies to ensure strategy robustness

Enabling Dynamic Adaptation: Creating systems that can detect market regime changes and adapt accordingly

Powering Autonomous Operations: Delivering end-to-end AI-powered fund management from strategy creation to execution

As World Fund evolves, we envision an ecosystem where:

Quantitative trading strategies become accessible to everyone, not just specialized institutions

The quality of trading strategies improves through rigorous scientific validation

Market efficiency increases as sophisticated strategies become more widely deployed

Capital allocation becomes more meritocratic based on genuine strategy performance

Ultimately, World Fund aims to create a more equitable financial ecosystem where:

Access to sophisticated trading tools is determined by ideas, not institutional affiliation

Strategy performance is the result of genuine insight, not data mining and overfitting

AI works alongside humans to enhance creativity and execution efficiency

The boundaries between traditional and decentralized finance continue to blur

By combining the best elements of artificial intelligence, quantitative finance, and blockchain technology, World Fund stands at the forefront of the next evolution in decentralized finance—creating a more accessible, efficient, and innovative investment landscape for all participants.

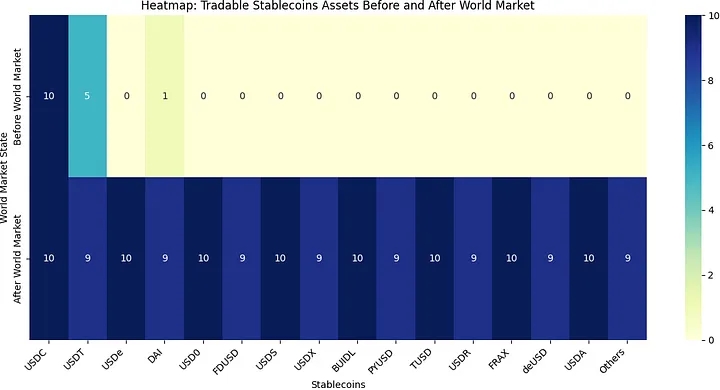

Stablecoins Everywhere, But Where Are the Markets to Use Them?

The crypto space is flooded with stablecoins, yet they offer little beyond holding value. Even as a holder, what can you actually do with them? Can you buy crypto directly? No, they’re often swapped into USDC or ETH or SOL first. Can you use them seamlessly in order books? Absolutely not — USDC dominates there too. Are there meaningful utilities elsewhere? Perhaps, but they remain limited.

Stablecoins promised to revolutionize DeFi, yet their utility remains painfully narrow. It’s time to rethink how stablecoins integrate with broader markets and unlock their true potential beyond just sitting idle or being intermediaries in swaps. DeFi deserves better.

The AI layer houses autonomous components that operate with minimal human intervention, forming the intelligent core of the World Fund ecosystem.

The Quant Agent is the central intelligence engine that generates, tests, and optimizes trading strategies through an iterative process:

Strategy Generation: Creates trading strategies based on both historical patterns and financial principles

On-chain perpetual markets are more than isolated trading venues — they are the foundational DeFi Legos for building the next wave of innovative financial products. This untapped potential is an open invitation to pioneers ready to redefine composability and unlock opportunities that no one has explored yet.

We are building the World Market to unlock this the new era of DeFi.

Why is World Market so important?

If you believe that

The use case of decentralized finance is permissionless global markets.

The addressable market for global liquidity is boundless in DeFi.

This document draws on a wide range of research and foundational work in quantitative finance, artificial intelligence, and decentralized systems. The following references provide additional context and background for the concepts presented in this litepaper.

Bailey, D. H., Borwein, J. M., López de Prado, M., & Zhu, Q. J. (2014). Pseudo-Mathematics and Financial Charlatanism: The Effects of Backtest Overfitting on Out-of-Sample Performance. Notices of the American Mathematical Society, 61(5), 458-471.

Any market requires one or more assets to be whitelisted for its successful creation. A non-whitelisted asset cannot be used for market creation. The protocol uses a two-step process to reduce the protocol’s security and systematic risk. All the logical implementation of handling asset-related parameters is stored in the Asset Manager. All asset-related parameters are available to be configured at the time when the user requests whitelisting of an asset by calling requestAddAsset(), which takes several asset-related parameters. Upon receipt of such request, the protocol validates the request and handles the addition of the assets based on risk parameters.

Some of the key parameters for an asset, for example, ETH requested to be whitelisted are:

Shortable: Allow anyone to short ETH.

Longable: Allow anyone to long ETH.

Stable: Allow anyone to use ETH as a stablecoin asset in the protocol.

Longable: Allow anyone to long ETH.: Allow anyone to use ETH as a collateral for trading.

Reference: Allow anyone to use ETH as a reference asset.

Several attack vectors have been mitigated for the long-term sustainability of the protocol across different core components, which can be summarized as:

As one of the oldest and still most common attack vectors for DeFi in general, front-running has been mitigated by using a two-step process for all actions corresponding to the user’s intent. For any user’s intent, there will be a request, then validation, and finally, there will be a response in the form of rejection or execution.

Front-running, a persistent threat in Decentralized Finance, has been effectively addressed through the adoption of a two-step process for all user actions. This approach ensures that each user's intent undergoes a thorough validation process, starting with a request and resulting in a response of either rejection or execution of the action.

The protocol implements a two-step process for all user actions where each user’s intent undergoes an adaptive validation process

Despite the rapid growth of DeFi, the creation and management of investment funds within this ecosystem face significant challenges that limit innovation, accessibility, and performance. World Fund addresses four critical problems that currently hinder the development of sophisticated fund management in decentralized finance.

Developing and managing investment funds in DeFi requires extensive technical expertise across multiple domains:

Smart contract development skills for creating fund structures and executing trades

The settlement design has been briefly explained in the section below:

Launch incentive-based stablecoins for ecosystem growth

And so much more, fueling DeFi’s evolution and scalability.

Generate more yield for stakers through innovative solutions

Earn additional yield for your treasury by participating as a World Market LP

And much more, pushing the boundaries of DeFi innovation.

Hedging LP positions or generating more yield

Trading LP positions or with LP tokens

Going long or short on the world’s markets

Engaging in basis-point trading strategies

Trading seamlessly without the need for bridging or switching chains

Security Audits: Regular third-party security audits of all components

Innovation accelerates through the open architecture enabled by the Model Context Protocol

Rigorous Validation: Employs advanced techniques to prevent overfitting and ensure strategy robustness

Adaptive Optimization: Continuously refines strategies based on changing market conditions

Multi-model Approach: Leverages multiple AI models to analyze different aspects of market behavior

MCP Integration: Extends capabilities through the Model Context Protocol to access specialized tools

AI-operated funds execute strategies autonomously, managing capital based on carefully validated approaches:

Autonomous Operation: Funds run with minimal human intervention based on predefined strategies

Risk-aware Execution: AI continuously monitors and adjusts positions based on risk parameters

Regime Detection: Systems automatically identify market regime changes and adapt accordingly

Multi-strategy Deployment: Single funds can operate multiple uncorrelated strategies simultaneously

Transparent Reporting: Despite autonomous operation, all actions are fully auditable and explained

The Trader AI Agent focuses exclusively on optimizing trade execution based on strategic directives:

Execution Optimization: Minimizes slippage and market impact through intelligent order routing

Adaptive Timing: Adjusts execution timing based on market conditions and volatility

Multi-venue Execution: Can execute across different liquidity pools for optimal pricing

Cost Analysis: Continuously analyzes and reports on transaction costs and execution quality

Order Type Selection: Intelligently selects between market, limit, and advanced order types

The AI components are built on a sophisticated intelligence architecture:

Ensemble Methods: Multiple models working in concert to improve decision quality

Explainable AI: All decisions can be traced and explained, avoiding "black box" approaches

Reinforcement Learning: Systems improve over time based on execution results

Transfer Learning: Knowledge from one market or asset class can be applied to others

Anomaly Detection: Continuous monitoring for unusual market conditions or system behavior

This layered AI approach creates a robust system where each component specializes in a specific aspect of the fund management process, while maintaining clear separation between strategy generation, signal processing, and order execution.

The killer usecase of DeFi is creating markets that have the power to transform the world.

Why now?

This is because:

Many high-performance chains are pushing the theoretical limits of transactions per second with ultra-low latency block times.

These chains offer gigagas capacity, enabling complex computations without running out of gas.

Blockchain-level automation is now possible, powering high-performance systems with ease.

Low-latency, high-performance oracles operate entirely on-chain, ensuring seamless utilization.

AI-Agentic future enables better interoperability, enhanced risk management, and on-time execution, all with high efficiency.

All of this is achieved at a fraction of the cost compared to past blockchain systems.

We believe with such developments and many more to come, DeFi markets can start going head to head with CEX’s on performance and scale to support TradFi volumes down the line.

World Market is not just a vision, its a call to action for all.

LeverageTradingEnabled: Allow anyone to open ETH trades. Works only if Reference, Shortable and Longable are true for ETH.

DecentralizedSourcesEnabled: Allow ETH to have decentralized pricing source such as Chainlink, Pyth etc. for price discovery.

CentralizedSourcesEnabled: Allow ETH to have real world pricing sources such as Binance, Bybit, etc for price

For each asset, the Asset Manager will create an object of type CryptoAssetProps or TimedMarketAssetProps after performing mandatory checks actions both on-chain and off-chain, such as validating price feeds, chainids of the addresses and asset parameters. Upon passing all the valid checks, the asset will be whitelisted in the protocol to be used as a market asset.

As decentralized finance continuous to grow, we will see influx of unique assets emerging which can also be whitelisted in the protocol to create a market.

While this is not common, the on-chain contracts and off-chain infrastructure are purposefully designed to handle the cases where such events occur allowing for the operation of the protocol to adapt as needed.

Once the blocks are being produced, the prices in the pendingQueue will be reviewed and validated before any existing or previous orders are executed by the Execution Engine.

If a bad actor requests asset whitelisting, creation of a market, modification of a market, or other asset/market related parameters, the Asset Manager will handle proper validation before any request is passed onto the Execution Engine. The Execution Engine will run its own validation checks to ensure that no malicious actions disguised as requests are executed. In the early stages of the protocol, several additional internal checks will be followed until the protocol is handed over to the DAO for decision-making.

Several validation logics have been implemented on the on-chain and off-chain infrastructure to ensure maximum possible security. As previously shared, our two-step process reduces the chances of MEV and OEV attacks to almost zero.

Quantitative finance knowledge for designing effective trading strategies

Data science capabilities for analyzing market data and performance metrics

Blockchain infrastructure understanding for efficient on-chain operations

This high technical barrier prevents many talented fund managers from participating in the DeFi ecosystem, limiting the diversity and innovation of available investment options.

Trading strategies often perform well on historical data but fail in live markets due to overfitting:

Conventional backtesting methods frequently produce misleading results

Limited tools exist for rigorous out-of-sample validation in DeFi environments

Few platforms offer systematic approaches to strategy validation across different market regimes

Cryptocurrency markets are characterized by rapidly changing conditions and regime shifts:

Most trading strategies are optimized for specific market conditions

Manual intervention is typically required to adjust strategies, creating operational friction

Few solutions exist for automatically detecting market regime changes and adapting accordingly

While AI has transformed many industries, its application in autonomous fund management remains underdeveloped in DeFi:

Current AI implementations in trading are often limited to signal generation rather than end-to-end fund management

Existing solutions lack the ability to autonomously execute complex strategies while managing risk

Integration between AI systems and on-chain execution remains fragmented

World Fund's architecture directly addresses these challenges through its integrated approach to fund creation, validation, adaptation, and autonomous operation. Discover how in our Architecture Overview and Core Components sections.

Future-proofing through coordinated development roadmaps between both platforms

Skew-based Funding Fees

When traders open a trade on the protocol, an opening fee is deducted from the collateral to facilitate execution of the trade. Similarly, a closing fee is deducted from the collateral when the traders close their positions.

The opening and closing fees are fixed and depend on the market creator. Hence, each market may have different fees.

The market pool acts as a counterparty in an event of market skew. Hence, all positions pay a borrowing fee on hourly basis for sustainable operation of the protocol in event of skew. In case, there is no skew and very low Open Interest, borrowing fees tend to be 0.

Let be the total time interval in hours until which the position was opened for, then borrowing fees of the position, at any time can be defined as

and we can define as

where is the reserve amount in USD for all opened positions at time , is the total reserve amount in USD for the market, is the maximum allowed borrowing fees for the market defined and is the position size.

Since ,, are constant throughout the position time, so

hence, we can say as the open interest of the market increase the borrowing fees increase and vice versa.

Let the Active Open Interest Skew be , then

where is the sum of open interest on Long side, be the sum of open interest on short side and be the sum of total open interest in USD.

If represents pool's maximum reserve amount available for an asset, then

Then the funding fee of a position can be defined as

where is the asset's funding constant and is the asset's funding power constant.

The possible output of the function is which means long will pay short and means shorts will pay long.

LPs assets (Aave staked asset, Pendle’s PT, GLP, GM, gDAI, etc) as well as B3X's World Market LP token,

MEMEs (MEME, PEPE, SHIB, etc)

and much more.

López de Prado, M. (2018). Advances in Financial Machine Learning. Wiley.

Aronson, D. (2006). Evidence-Based Technical Analysis: Applying the Scientific Method and Statistical Inference to Trading Signals. Wiley.

Kakushadze, Z., & Serur, J. A. (2018). 151 Trading Strategies. SSRN Electronic Journal. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3247865

Sutton, R. S., & Barto, A. G. (2018). Reinforcement Learning: An Introduction (2nd ed.). MIT Press.

Goodfellow, I., Bengio, Y., & Courville, A. (2016). Deep Learning. MIT Press. https://www.deeplearningbook.org/

Chollet, F. (2021). Deep Learning with Python (2nd ed.). Manning Publications.

Brown, T. B., Mann, B., Ryder, N., Subbiah, M., Kaplan, J., Dhariwal, P., ... & Amodei, D. (2020). Language Models are Few-Shot Learners. arXiv preprint arXiv:2005.14165.

Buterin, V. (2014). Ethereum: A Next-Generation Smart Contract and Decentralized Application Platform. https://ethereum.org/en/whitepaper/

Adams, H., Zinsmeister, N., & Robinson, D. (2020). Uniswap v2 Core. https://uniswap.org/whitepaper.pdf

Schär, F. (2021). Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets. Federal Reserve Bank of St. Louis Review, 103(2), 153-174. https://research.stlouisfed.org/publications/review/2021/02/05/decentralized-finance-on-blockchain-and-smart-contract-based-financial-markets

Peretz, G., O'Neil, R., & Krowiak, R. (2021). Automated Market Makers and Decentralized Exchanges: A DeFi Primer. Journal of Financial Transformation, 52(1), 47-59.

Wu, T., Li, Z., Yang, Y., Huang, Z., Ding, L., Yang, C., ... & Zhao, Z. (2023). BloombergGPT: A Large Language Model for Finance. arXiv preprint arXiv:2303.17564. https://arxiv.org/abs/2303.17564

Yang, K., Gan, Z., Pang, P.N., Su, Y., & Dai, X. (2023). FinGPT: Open-Source Financial Large Language Models. arXiv preprint arXiv:2306.06031. https://arxiv.org/abs/2306.06031

Wu, C., Raghunathan, A., Zhang, C., Benmohamed, P.R., & Hooi, B. (2023). Trading with Language Models: An Analysis of their Predictive Power and Limitations. arXiv preprint arXiv:2309.12别9. https://arxiv.org/abs/2309.12819

This type of liquidation is initiated for active positions which are in profit to minimize risk for market skew and for positions which are in loss to minimize isolated risk for the position. This enables the protocol to mitigate systematic risk such as missed liquidations or an over-leveraged position which may affect the market negatively. This is handled via ADL Engine which may take hold of the position once it reaches the maximum risk factors defined in market, asset or position.

Let us define the PnL factor for a position in profit, using PnL, for the position as

Since is a constant, hence the relation can be established as

For any position, we already defined leverage as as

We already know that for the positions in profit after fees for reference,

And for positions in loss after fees,

This can be plotted as

If a partial liquidation occurs in any market, it will create an imbalance in that market’s Open Interest which will be balanced by the funding fees skew in subsequent topic. This method of liquidation is often only applicable to the positions with leverage under maximum defined leverage and may pay out profit or left-over collateral.

When the position’s margin falls the factor defined by the market, it is added in the monitoring queue for the liquidator to execute liquidation of the position. Hence when,

where is the liquidator fees which is a fixed value in USD. In this method type of liquidation, the position is taken over by the protocol’s liquidator and closed with a loss for the traders and as a gain for the market. This is applicable to all positions having leverage above maximum starting leverage defined by the market or at the price when is less than , the position’s margin is under minimum required maintenance margin, which is triggered first.

"Get smart people together, give them a lot of freedom, create an atmosphere where everyone talks to everyone else, provide the best infrastructure, and make everyone partners."

Jim Simons, founder of Renaissance Technologies

World Fund is a modular AI-powered platform that revolutionizes the creation and management of investment funds in the DeFi ecosystem. By leveraging cutting-edge Large Language Models and machine learning algorithms, World Fund enables users to build trading strategies using natural language, avoid overfitting through rigorous out-of-sample backtesting, and deploy autonomous AI agents that can adapt to changing market conditions.

- Build trading strategies through simple conversations

- Scientifically validate and optimize strategies while preventing overfitting

- Deploy validated strategies through a decoupled event-driven architecture

Discover how these features work together in our .

World Fund is designed for optimal integration with World Market, our purpose-built Perpetual DEX. This synergistic relationship ensures maximum performance, security, and feature compatibility between both platforms.

The Fund Builder is a revolutionary component that democratizes access to sophisticated fund creation through natural language interfaces. By removing technical barriers, it enables both experienced fund managers and retail investors to create and deploy trading strategies without programming expertise.

At the core of the Fund Builder is its ability to translate human language into executable trading strategies:

Multilingual Support: Users can describe trading strategies in their native language (English, French, Spanish, Chinese, and more)

Natural Language Interface: Complex trading ideas can be expressed in everyday language

LLM-Powered Code Generation: Advanced AI models translate these descriptions into optimized code using the B3X SDK

Interactive Refinement: Users can iteratively refine their strategies through conversational feedback loops

The Fund Builder guides users through a structured strategy creation process:

Strategy Description: User describes their trading idea in natural language

AI Interpretation: System interprets and formalizes the strategy

Parameter Configuration: User sets and adjusts key parameters with AI assistance

Strategy Visualization: System generates visual representations of strategy logic

The Fund Builder prioritizes accessibility without sacrificing sophistication:

No-Code Interface: Complete elimination of coding requirements

Strategy Templates: Pre-built templates for common strategy types

Educational Guidance: Contextual education on strategy components and financial concepts

Risk Assessment: Clear explanation of potential risks and limitations

User: "I want to create a strategy that buys Bitcoin when the 50-day moving average crosses above the 200-day moving average, and sells when it crosses below."Fund Builder: "I understand you want to implement a Golden Cross/Death Cross strategy for Bitcoin. Let me design that for you. This strategy will:

Buy BTC when the 50-day MA crosses above the 200-day MA (Golden Cross)

Sell BTC when the 50-day MA crosses below the 200-day MA (Death Cross)

Would you like to add any filters or additional conditions to this strategy?"

User: "Yes, only enter if the volume is above average."Fund Builder: "Great addition. I'll modify the strategy to only trigger entries when:

The 50-day MA crosses above the 200-day MA (Golden Cross), AND

The current volume is above the 20-day average volume

This should help filter out false signals. Would you like to add a specific position sizing rule or risk management parameter?"

Behind its intuitive interface, the Fund Builder leverages sophisticated technology:

Strategy Parsing Models: Specialized LLMs trained to understand trading concepts

Code Generation Pipeline: Multi-stage process for translating natural language to executable code

Validation Circuits: Systems to ensure generated strategies meet technical and risk standards

User Intent Analysis: AI models that understand the user's true objectives beyond literal instructions

The Fund Builder connects seamlessly with other components in the World Fund ecosystem:

Strategies flow directly to the Quant Agent for scientific validation

Approved strategies are stored in the Curated Strategy Library

Deployed strategies interface with the Signal Generator and Trader Agent for execution

By combining natural language processing with financial expertise, the Fund Builder creates an unprecedented level of accessibility to sophisticated quantitative trading, empowering users regardless of their technical background.

An Overview of Economical Model of World Fund

The World Fund includes a range of fees applicable to its various financial and operational activities. These fees are designed to cover fund operations, align incentives, and ensure efficient capital deployment. The fee structure includes:

Vault Creation Fees – Charged when a new vault is created within the World Fund ecosystem.

Deposit Fees – Applied when users deposit capital into a World Fund vault.

Withdrawal Fees – Incurred when users withdraw funds from a vault.

Performance Fees – A percentage of profits generated by the vault, typically allocated to fund managers or the protocol treasury.

Management Fees – Recurring fees charged for managing and maintaining the vault and its underlying strategies.

Protocol Fees - A fixed or percentage-based fee collected for running the vault operations.

The foundation of the World Fund ecosystem provides essential services and tools that support all higher-level components. This layer delivers the technical backbone that enables sophisticated fund creation, management, and execution.

The infrastructure layer includes specialized trading tools:

Smart Contracts: Purpose-built contracts for fund creation, capital allocation, and strategy execution

Liquidity Pools: Integration with World Market liquidity pools optimized for algorithmic trading

Order Execution: Advanced order types and execution algorithms

Position Management: Tools for tracking and managing positions across multiple assets

Risk Controls: Infrastructure for enforcing risk parameters and circuit breakers

The Curated Strategy Library stores validated trading strategies that have passed rigorous testing:

Strategy Repository: Secure storage of validated strategy code and parameters

Version Control: Tracking of strategy versions and performance across time

Access Controls: Fine-grained permissions for strategy access and modification

Component Reuse: Library of building blocks that can be combined to create new strategies

Comprehensive quantitative tools support strategy development, testing, and selection:

Backtesting Engine: High-performance system for testing strategies against historical data

Out-of-Sample Validation: Tools specifically designed to prevent overfitting

Walk-Forward Analysis: Systems for testing strategy robustness across time

Regime Analysis: Tools for identifying and testing performance in different market conditions

Robust data infrastructure manages the flow of market data and signals:

Market Data Feeds: Real-time and historical data from multiple sources

On-chain Analytics: Processing and analysis of blockchain data

Alternative Data: Integration of sentiment, social, and other non-traditional data sources

Data Normalization: Tools for cleaning and standardizing data across sources

Comprehensive security systems protect both funds and intellectual property:

Secure Agent Wallets: Limited-permission execution wallets for safe strategy operation

Multi-signature Controls: Governance systems for critical operations

Audit Trails: Complete logging of all system actions for transparency

Strategy Encryption: Protection of proprietary trading strategies

This infrastructure layer provides the solid foundation upon which the entire World Fund ecosystem operates, ensuring reliability, security, and performance at scale.

The Strategy Framework provides the structure for creating, validating, and executing trading strategies within World Fund. At its core is the Strategy Factory and Strategy Selector (SFSS) system that ensures strategies meet rigorous standards before deployment.

The SFSS system represents the core architecture for strategy generation, validation, and selection. It follows a structured workflow to ensure only robust, validated strategies reach deployment and are dynamically selected based on current market conditions.

The Execution Layer of World Fund implements a decoupled event-driven architecture that separates strategy processing from order execution. This design creates a clear division of responsibilities, allowing each component to specialize in its specific function.

The execution architecture follows a clear sequence of events:

Backtesting Preview: Initial backtesting results are presented for review

Refinement Dialog: User and AI engage in iterative improvement

Validation Handoff: Completed strategy is sent to the Quant Agent for rigorous validation

Historical Analogies: Comparison to similar historical strategies for context

Performance Tracking: Historical data on strategy performance across different market regimes

Monte Carlo Simulation: Probabilistic testing of strategy performance under various scenarios

Parameter Optimization: Tools for finding optimal strategy parameters while avoiding overfitting

Feature Engineering: Systems for creating meaningful inputs for strategies

Circuit Breakers: Automated systems to halt trading under extreme conditions

The Strategy Factory is responsible for strategy creation through multiple pathways:

User-Defined Strategies: Created through the Fund Builder's natural language interface

Quant Agent Generation: AI-generated strategies based on market patterns and opportunities

Template Modification: Customization of pre-existing strategy templates

Expert Design: Manually coded strategies by professional quantitative analysts

The Strategy Selector dynamically chooses the most appropriate strategies based on current market conditions, optimizing performance across different regimes:

Market Regime Detection: Identifies distinct market environments (trending, ranging, volatile) using a combination of statistical pattern recognition and machine learning

Dynamic Strategy Allocation: Automatically adjusts capital allocation across strategies based on their historical performance in similar market conditions