Solving the Crypto UX Nightmare

The Average Crypto User: A Tale of 100x Gains and a Maze to Navigate

Imagine you’ve already invested in ai16z and made your 100x return. Now, you want to diversify into jitoSOL on Solana, sUSDe on Ethereum, and OM on Mantra for stable yields and exposure to Solana’s price action and RWA chains.

The current process would involve selling ai16z, using part of it to buy jitoSOL, then bridging some to Ethereum to swap for sUSDe or stake it. You’d then swap to sUSDe, and finally, bridge the rest to Mantra to buy OM or stay on Ethereum to purchase OM there.

This is a terrible user experience. Most users will struggle with this complexity. We’re not there yet, even with AI agents. Users must navigate through three fundamentally different blockchains (Solana, EVM, Cosmos), which is overwhelming.

The World Market is here to eliminate this UX nightmare and onboard average users without the need for endless blockchain education.

With the World Market, you can directly use ai16z tokens to buy jitoSOL, sUSDe, and OM — no need for selling, bridging, or chain-hopping. Enjoy the same upside and yield while maintaining the full potential of your ai16z tokens.

Through the World Market, users can now:

Trade any asset or data stream, literally.

Trade using the majority of on-chain assets, for real.

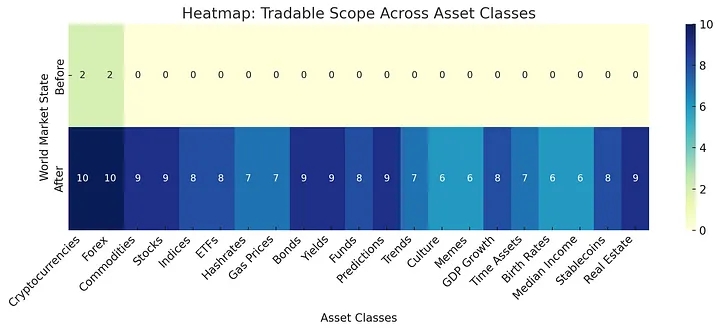

What can you trade on?

Cryptocurrency, forex, commodities, stocks, indices, etfs, hashrates, gas prices, bonds, yields, funds, predictions, trends, culture, memes, gdp growth, time assets, birth rates, median income, stablecoins, real estate, and so much more.

World Market presents infinite possibilties.

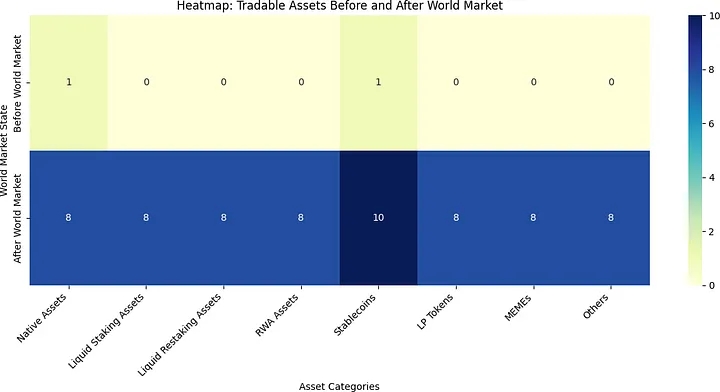

What can you trade with?

Almost any onchain asset including:

native assets (BTC, ETH, SUPRA, etc),

liquid staking assets (wstETH, rETH, LBTC, etc),

liquid restaking assets (eETH etc),

RWA assets (BENJI, BUIDL, etc),

stablecoins (cdxUSD, lvlUSD, USDe,, USDM, DAI, FUSD, USD0, USDS, USDX etc),

LPs assets (Aave staked asset, Pendle’s PT, GLP, GM, gDAI, etc) as well as B3X's World Market LP token,

MEMEs (MEME, PEPE, SHIB, etc)

and much more.

Your portfolio holds more value than you think — capitalize its true potential with the World Market.

Last updated

Was this helpful?